2022 tax brackets

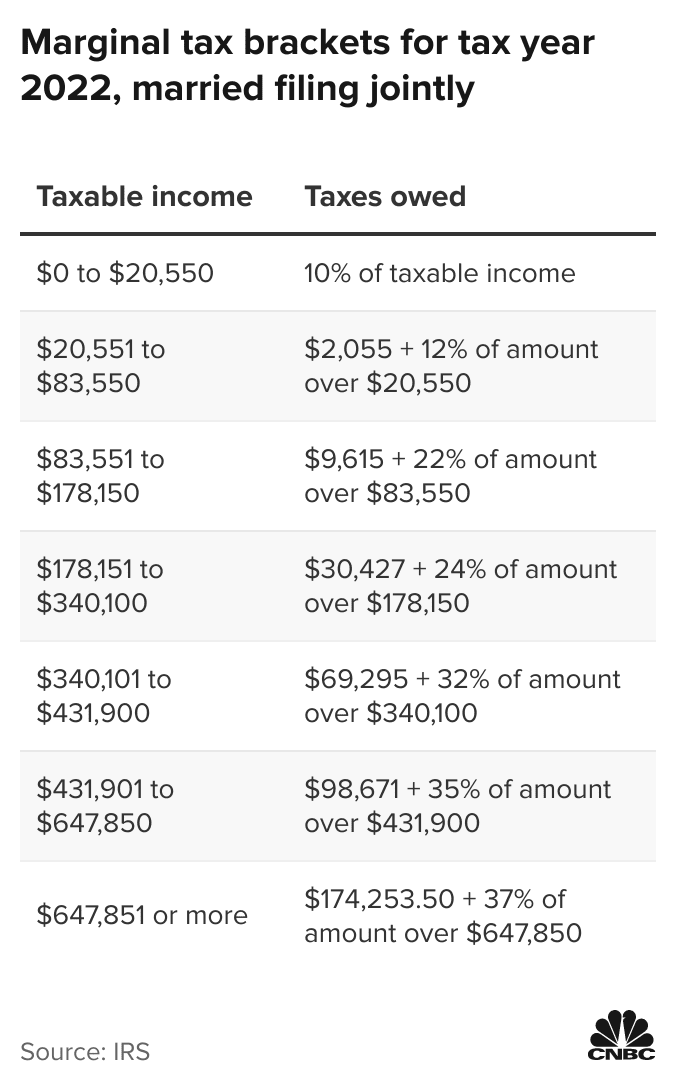

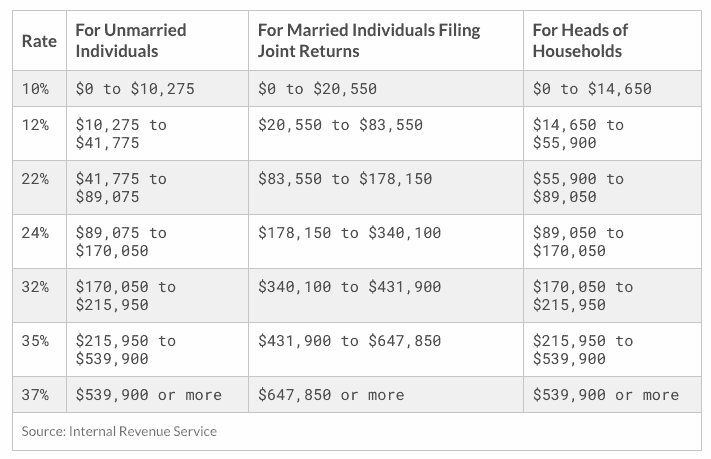

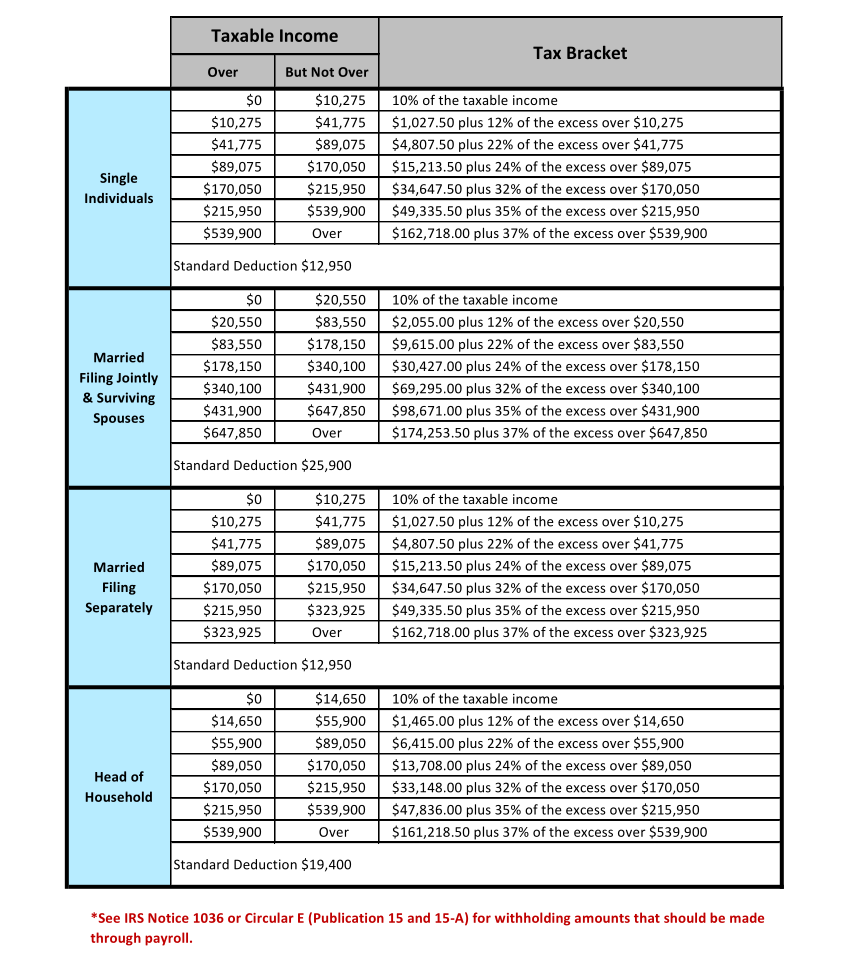

15 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals.

State Income Tax Rates And Brackets 2022 Tax Foundation

A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable income for the year.

. Heres a breakdown of last years. 2022 tax brackets Thanks for visiting the tax center. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

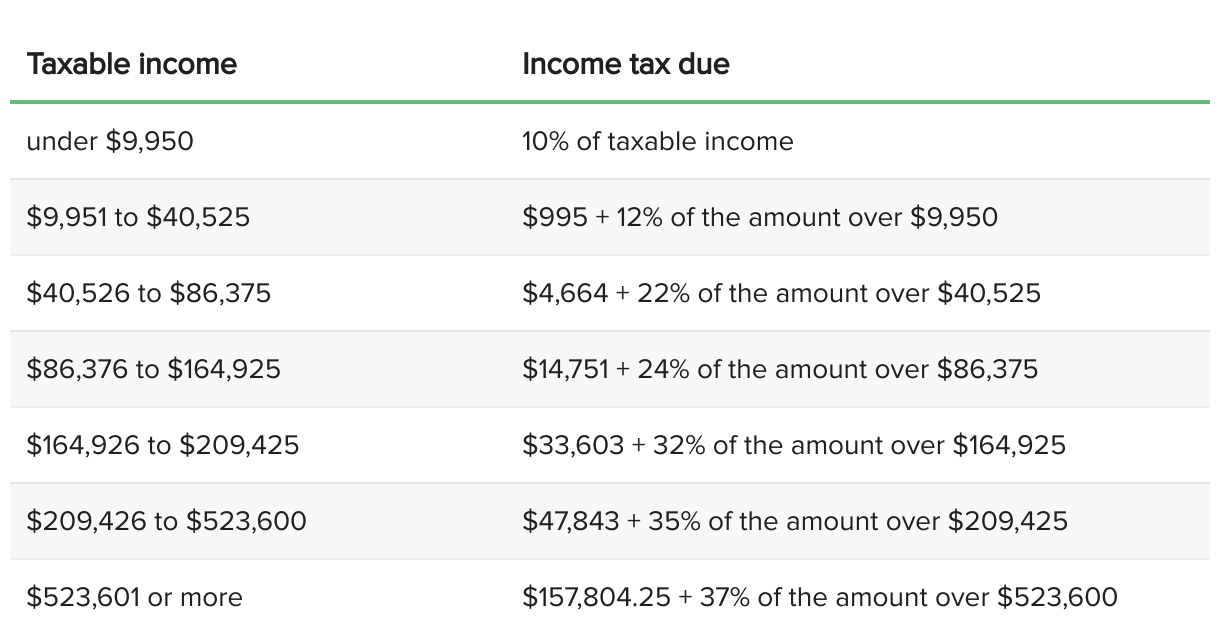

12 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. 10 12 22 24 32 35 and 37. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075. Single filers may claim 13850 an increase. The top marginal income tax rate.

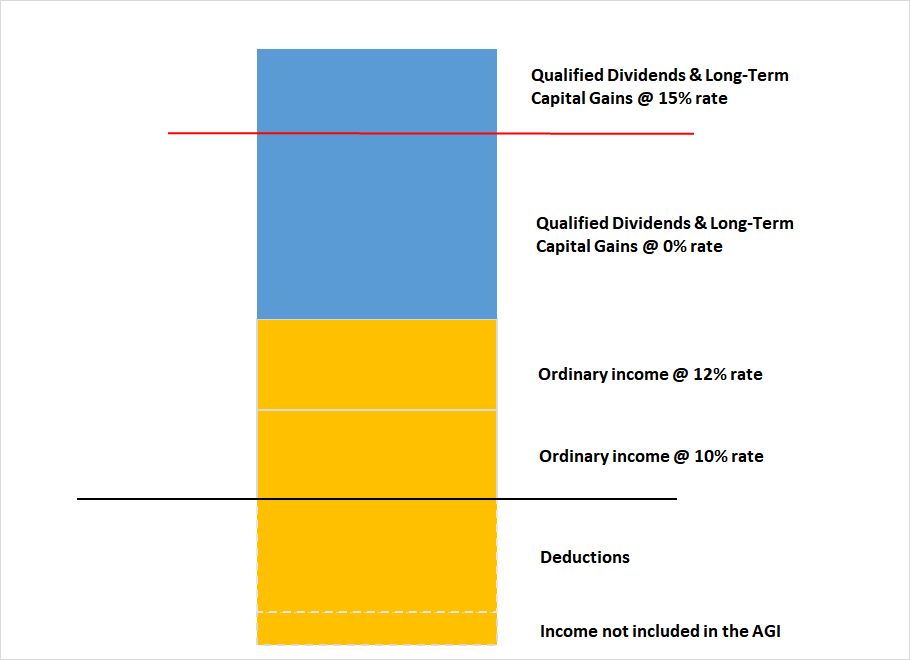

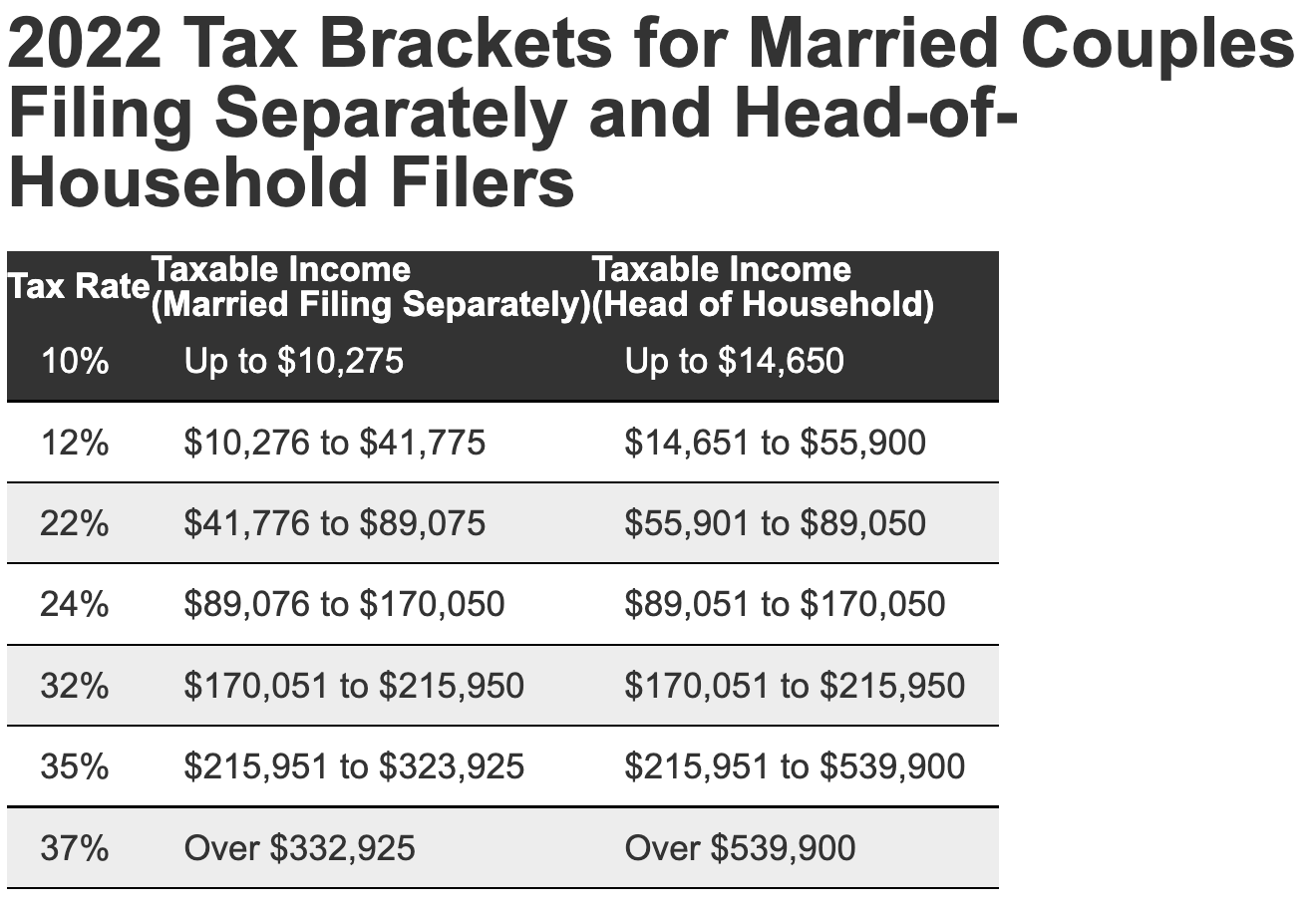

Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household. An additional 38 bump applies to filers with higher modified adjusted.

11 hours ago2022 tax brackets for individuals. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. Tax brackets for long-term capital gains investments held for more than one year are 15 and 20.

There are seven federal tax brackets for the 2021 tax year. 16 hours agoThe standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. The IRS has set seven tax brackets 2022 taxpayers will fall into.

Your bracket depends on your taxable income and filing status. To access your tax forms please log in to My accounts General information. It is taxed at 10 which means the first 9950 of the.

Here are the 2022 Federal tax brackets. There are seven federal income tax rates in 2022. Income Tax rates and bands.

In tax year 2020 for example a single person with taxable income. The Internal Revenue Service. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. There are still seven tax rates in effect for the 2022 tax year. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy.

Ad Compare Your 2022 Tax Bracket vs. Resident tax rates 202122 The above rates do not include the Medicare levy of 2. Your 2021 Tax Bracket To See Whats Been Adjusted.

Below you will find the 2022 tax rates and income brackets. The lowest tax bracket or the lowest income level is 0 to 9950. Resident tax rates 202223 The above rates do not include the Medicare levy of 2.

These are the rates for. The 2022 tax brackets affect the taxes that will be filed in 2023. 2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for heads of.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of. Each of the tax brackets income ranges jumped about 7 from last years numbers. However as they are every year the 2022 tax brackets were adjusted to.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. The current tax year is from 6 April 2022 to 5 April 2023. Discover Helpful Information And Resources On Taxes From AARP.

10 12 22 24 32 35 and 37.

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

2021 2022 Tax Brackets And Federal Income Tax Rates

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

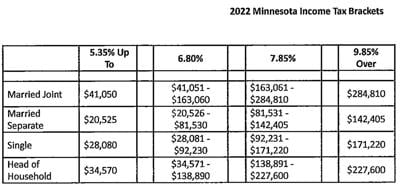

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

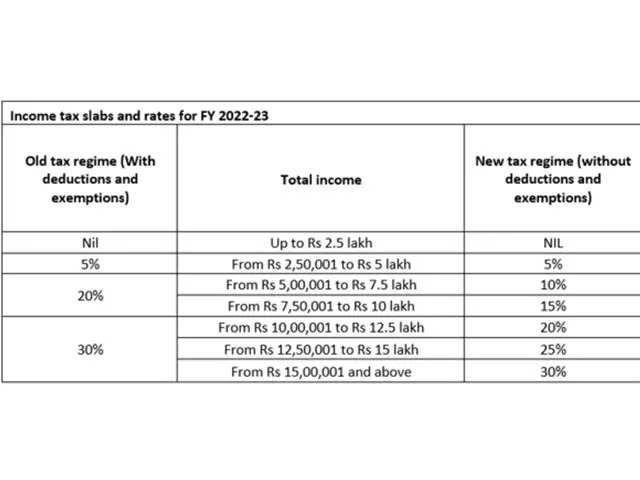

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

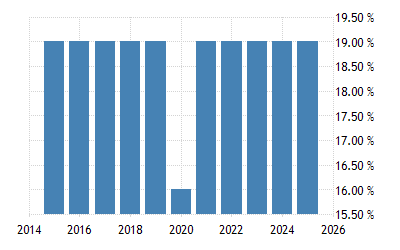

Germany Sales Tax Rate Vat 2022 Data 2023 Forecast 2000 2021 Historical

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Federal Income Tax Brackets For 2022 And 2023 The College Investor

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

What Are The Income Tax Brackets For 2022 Vs 2021

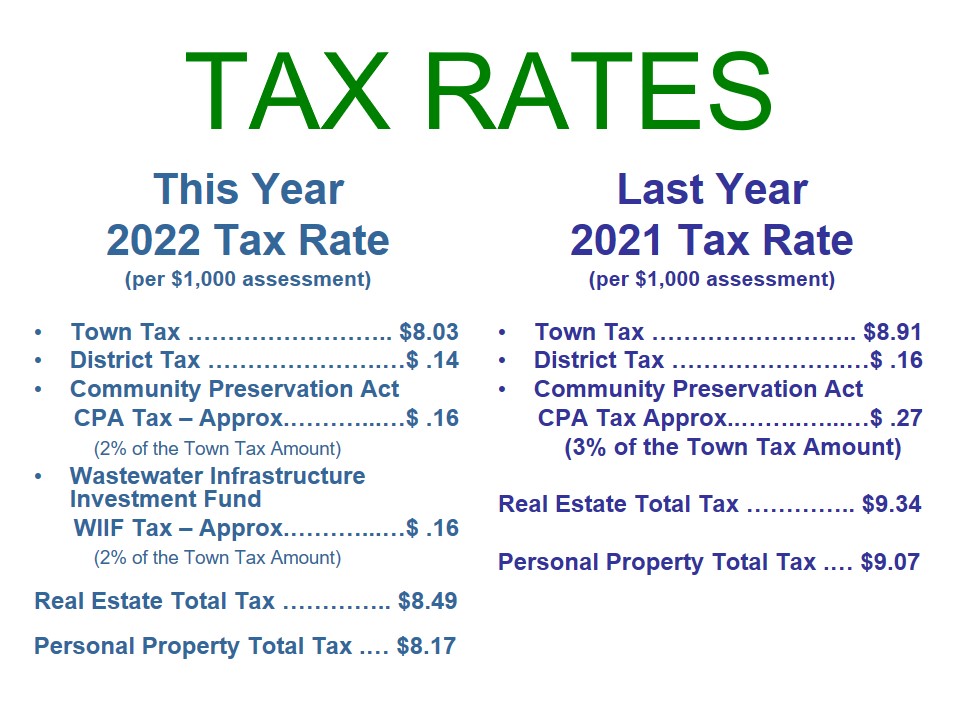

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

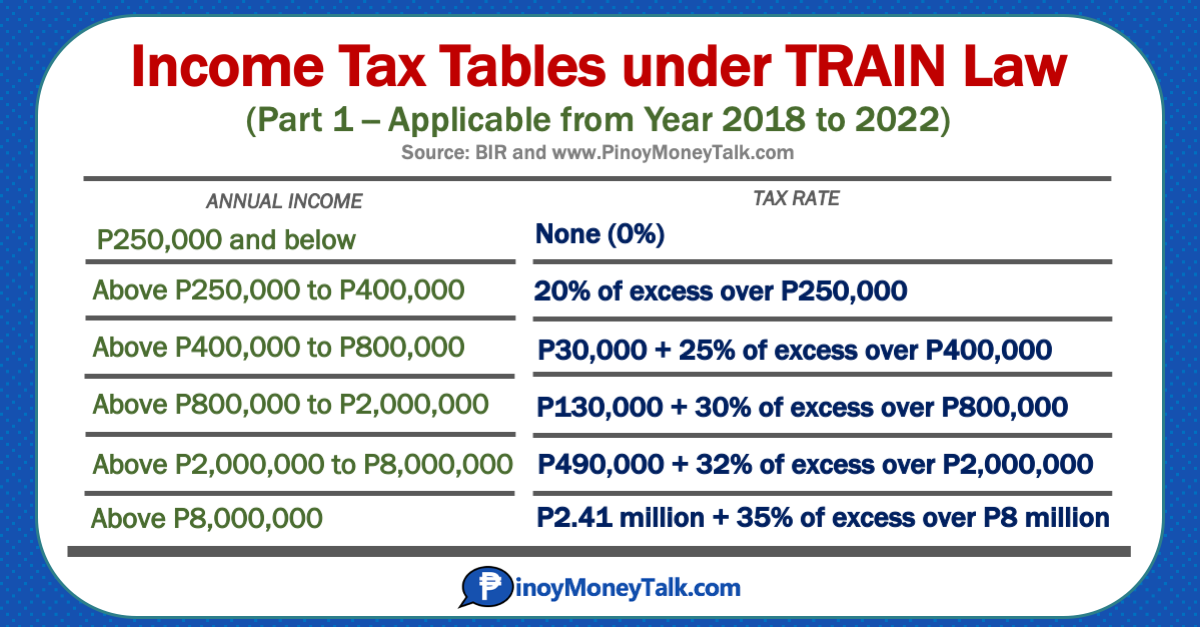

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Analyzing Biden S New American Families Plan Tax Proposal

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News